Gravestone Doji Candlestick: Spot It to Trade Reversals

Another popular way of trading the gravestone doji candlestick is using the Fibonacci retracement tool. Here are a few strategies to trade the Gravestone Doji pattern. It’s simple, the Gravestone Doji pattern is traded when the low of the candle is broken. A Gravestone Doji appearing after this bullish move is a sign of a possible reversal to the downside.

First, while they can be found at the end of a downtrend, they’re mostly found in an uptrend when a stock is about to reverse. In this article, we’ve covered the gravestone doji candlestick pattern. We’ve looked at its meaning, how to identify the pattern, and provided some tips on how to improve the pattern as well as a few example trading strategies.

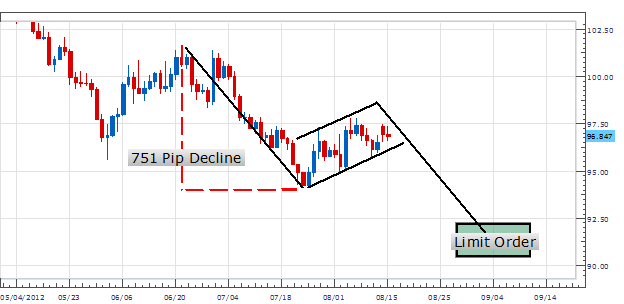

Strategy 5: Trading The Gravestone Doji With Fibonacci

Once again, as soon as the next (next) candlestick closes above the gravestone candle, the trend changes and the price rises again. In this case, a stop loss is placed below the lowest level of the bearish trend, and TP is placed at one of the previous price swing peaks. As such, it could be a trend reversal indicator or a trend continuation signal. To ensure it is a reversal signal, we added the Relative Strength Index (RSI) indicator and the Moving Average Convergence Divergence (MACD). Further, when trading the bearish gravestone candle pattern, a stop loss should be placed above the highest level of the gravestone candle. Below, we will show you the two cases and add the necessary technical analysis tools to help you learn how to confirm the trend reversal.

Publicly traded companies are required to report their earnings quarterly to the Securities and Exchange Commission (SEC) on what’s known as a Form 10-Q. Companies must also file an annual report of their earnings on a Form 10-K. You can find both types of filings on the SEC’s EDGAR database. From our example above, once you wait for more, AT&T reversed and moved higher only to stop us out of the position. If you find yourself emotional, take a small portion like 1/4 of your position and bag those profits. This way, if you move your stop lower, you’ll never be red on the position, giving you patience to let it work.

What Are Gravestone Doji Candlesticks?

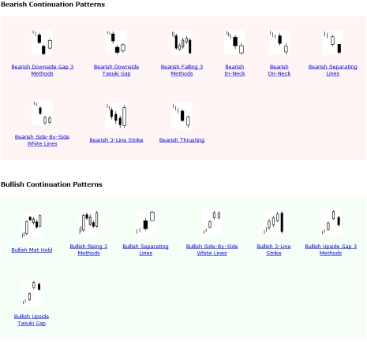

Unlike the bearish gravestone Doji candle pattern, the bullish version is considered less reliable. This is because the price bounced back up but finished the candle at the lowest level. But, an area of resistance is formed when it reaches the high of the day and the selling pressure pushes the prices back down to the opening price of the day.

Nasdaq 100 Technical: Exhaustion at key resistance … – MarketPulse

Nasdaq 100 Technical: Exhaustion at key resistance ….

Posted: Tue, 30 May 2023 07:00:00 GMT [source]

In this section we will provide examples of how to trade a Gravestone in an uptrend. This is a completely different picture from Phase 1 of the candlestick pattern. Recall that in the first phase of the candlestick pattern, the candlestick depicted a full bodied candle. The full-body candle in the first phase of the candlestick indicated Bull-strength. However, in this final stage we have a different picture to the story. Once again, we will begin with an analysis of the OHLC of the candlestick.

Nifty gains 1 percent, Rate cut hopes lift market.

This pattern suggests that sellers originally tried to drive the price down but, after a while, lost control, with buyers forcing the price back up to near the open. The lack of an upper shadow suggests that there was minimal or no inertia from sellers during the session. The Gravestone Doji and Dragonfly Doji are two candlestick patterns that are utilized in technical analysis to forecast future price movements.

It can hint that the price is about to fall, especially if it appears after one long uptrend or near a resistance line. We see a single red candle whose open and close prices are almost identical, with little to no lower shadow and a longer upper wick. The gravestone doji is a frequently occurring one-bar candlestick that’s typically thought of as an indecision candle or a reversal candle in a bull market.

Gravestone Doji Candlestick – (Trading Strategy and Backtest Definition & Meaning)

Contextually, when this occurs at the highs of an extended uptrend, we interpret this as exhaustion. This gives us the confidence to take a short position when all criteria are confirmed. The reverse of the Gravestone Doji is the bullish Dragonfly Doji.

Another quite powerful technique to improve on the pattern, is to measure range. To some extent, range provides the same information as volume, since they often are correlated. High volume usually translates into big range candles, and vice versa. Just like the neutral doji, a long-legged doji could be both bullish and bearish, depending on the preceding trend. However, the difference between the two is that a long-legged doji is longer than the neutral doji and indicates more uncertainty.

Therefore, the bullish advance upward was rejected by the bears. Keep in mind, however, that this isn’t the final phase of the candlestick. Until the candle officially “closes”, the Bulls may still be able to push the price back up and re-assert their former control. However, on the flipside, the Bears may be able to push the price down even further. The Gravestone Doji is typically viewed as a bearish doji candlestick. Or should we try to understanding the meaning behind what’s going on?

This is covered in- depth in our guide to building a trading strategy. As to the appearance, the neutral doji differs in that it has a lower and upper wick, which is not the case with the gravestone doji. A candlestick having longer wicks means that the stock experienced greater price volatility during that day. To know a stock’s price range over the course of a day, all an investor has to do is subtract the lowest price from the highest price. Bearish Gravestone Doji candle represents the change of trend from bullish into bearish if it forms in the overbought condition or at the top of the minor uptrend.

- On the other hand, the absence or minimal presence of a lower shadow indicates that sellers have successfully pushed the price down, closing near the low of the session.

- We don’t care what your motivation is to get training in the stock market.

- As a bearish reversal pattern, the Gravestone Doji is a great pattern to watch for when the price is on a downtrend.

- But we will follow the chart patterns in all other parameters.

- Fibonacci shows retracement levels where the price will tend to revert frequently.

Third, the gravestone doji tends to be a relatively accurate method of identifying reversals. Finally, it can easily be used together with other technical analysis tools. The only notable difference is that the shooting star pattern has a small body while a gravestone doji has no body.

US traders welcome at these brokers:

The https://g-markets.net/ pattern is a bearish trend reversal indicator. When a gravestone doji appears at the top of an uptrend, it carries more significance and suggests a higher probability of a trend reversal. This pattern indicates that buyers have lost their momentum and sellers are gaining control. The long upper shadow represents the market’s failed attempt to sustain higher prices, showing that selling pressure has entered the market.

Altria found resistance at the high of the day and subsequently fell back to the opening’s price. After an uptrend, the Gravestone Doji can signal to traders that the uptrend could be over and that long positions could potentially be exited. Once you have identified a valid gravestone doji candlestick, it will signal that a change in trend could occur. Generally, identifying the Gravestone Doji candle pattern is pretty straightforward.